Track SEC Form 4 Filings

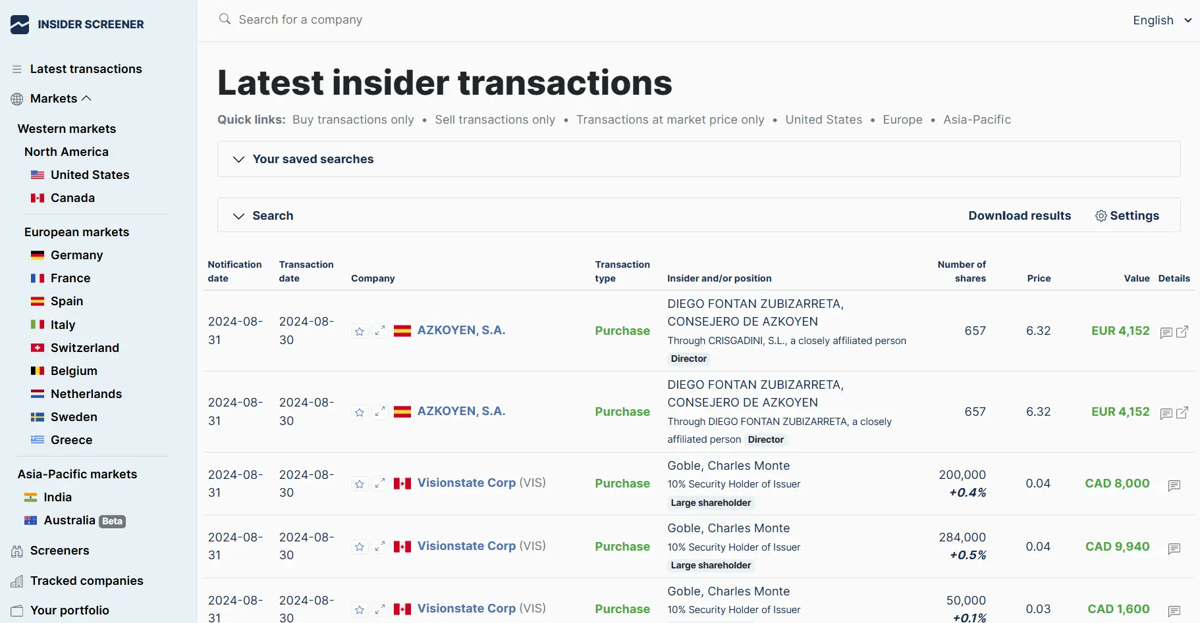

Find stocks that insiders are buying and selling

Monitor specific companies and industries

Receive daily email reports

Use the screeners to identify unusual transactions

Export data to Excel in .csv or .xlsx format

Filter out the noise with our advanced search function

Save hours of research time

DIY insider trading research

- Hours spent reading through individual filings

- Mostly irrelevant trades

- No alerts

Using insider screener

- Use screeners and advanced search to find investment opportunities

- Automatic detection of irrelevant trades

- Daily email alerts

Global coverage

insider screener tracks more markets than comparable platforms, allowing you to uncover investment opportunities in overlooked markets.

- All major markets in one place.

- Data from a dozen global markets, far more than comparable platforms - making insider screener the one stop shop for insider trading research

- Standardized data.

- Insider trading data is standardized across markets and regulations for easy comparison.

- Reliable and up-to-date information.

- Data is sourced directly for regulatory filings and is updated continuously, to ensure you have the latest data.

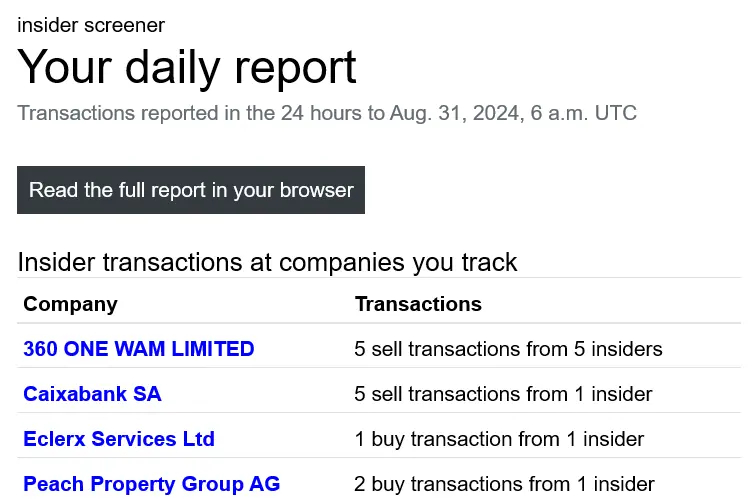

Daily email reports

Get daily email reports in your inbox, and make sure you never miss a trade.

- Track specific stocks.

- Get alerted daily of trades at companies you track.

- Custom criteria.

- Save your advanced searches and get daily alerts when new trades that meet the criteria are reported.

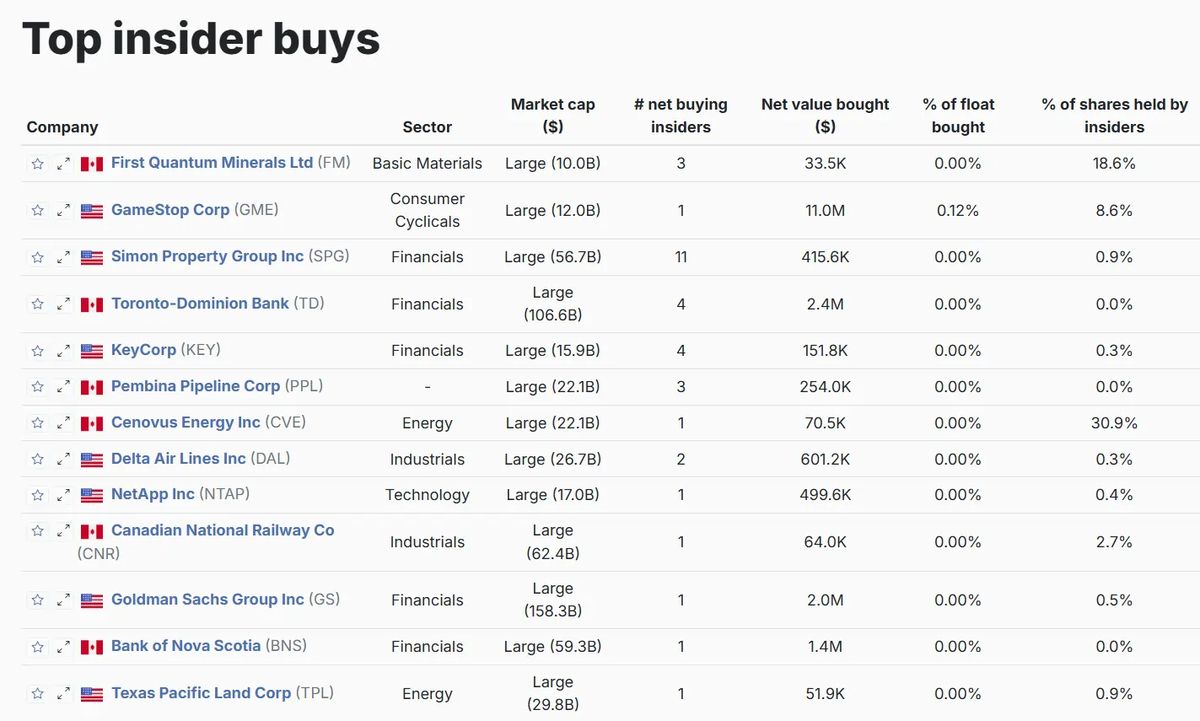

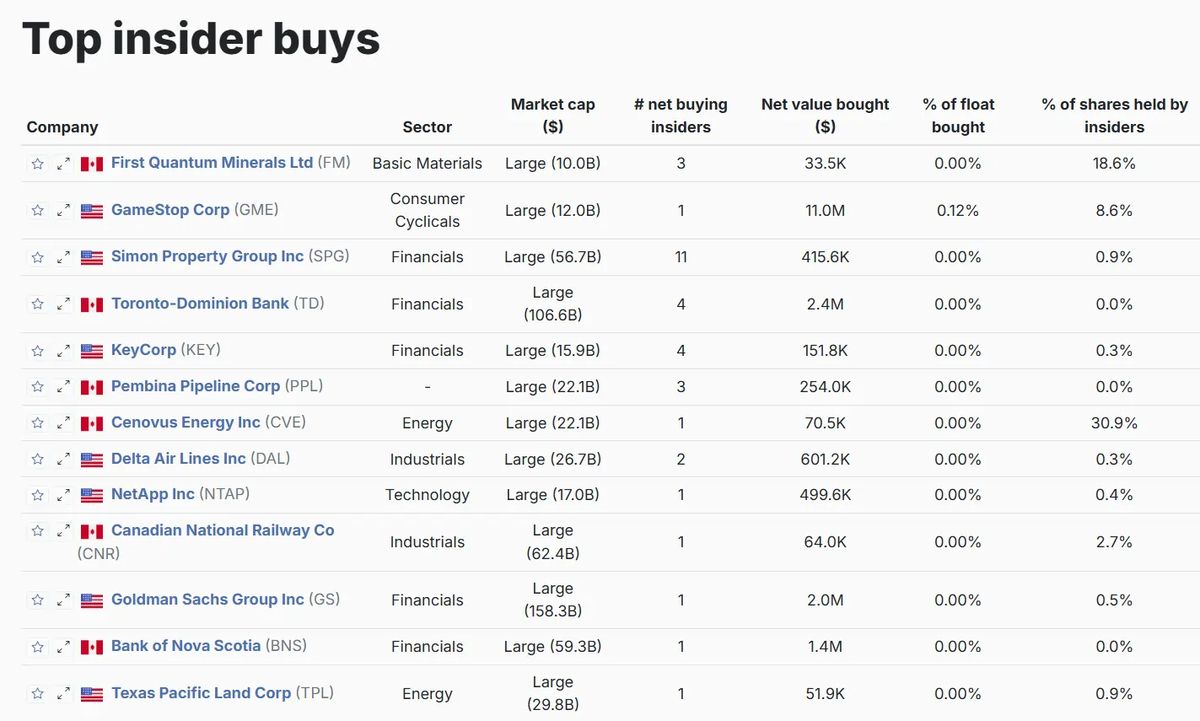

Powerful insights with screeners

The screeners analyze data continuously to highlight unusual insider trading activity.

- Top insider trading activity.

- insider screener highlights stocks with the most trading activity, from all insiders or specifically from executives.

- Context-based.

- insider screener highlights insider trading activity following specific events, such as the fall of the stock price.

- Data in context.

- insider screener analyzes insider trading activity with a multi-factor model, to put insider trading in the context of the specific stock.

Greetings,

insider trading data used to be difficult to access. Data was scattered across different financial regulators' websites, and it was hard to find the data you needed.

I set out to change that, and insider screener was born.

Today, insider screener is used by thousands of investors to access insider trading data.

In fact, insider screener is the only service offering access to data for so many markets at this price range.

If you want to add the analysis of insider trades to your trading or investing strategy, give insider screener a try.

Emmanuel from insider screener

P.S. If you have any questions, please contact me at [email protected]

Trending

How we source and process Form 4 and insider filings

We gather the data directly from the financial regulators or from the stock exchanges, depending on each market. We rigourously process the filings to remove the noise and bring to light the transactions relevant to investors.

Frequently asked questions

What is insider screener?

insider screener makes monitoring insider transactions easy.

Because reading through insider transactions filings published on the financial regulators' websites is a tedious task, we gather this data, analyze it and publish it so that you can find the data you need easily.

Where is the data coming from?

We gather the data directly from the financial regulators or from the stock exchanges, depending on each market.

Is insider transactions data legal?

Insider transactions data, which refers to information about the buying and selling of a company's stock by its officers, directors, and employees, is generally legal and publicly available. In many jurisdictions, companies are required to disclose insider transactions to regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or equivalent regulatory authorities in other countries.

These disclosures are intended to provide transparency and help prevent illegal insider trading.

Isn't insider trading illegal?

An insider transaction is the buying or selling of a company's securities (such as stocks or options) by individuals who have access to nonpublic information about the company, including officers, directors, and employees.

Insider transactions are legal and are not to be confused with illegal insider trading. The Securities and Exchange Commission defines illegal insider trading as "buying or selling a security, in breach of a fiduciary duty or other relationship of trust and confidence, on the basis of material, nonpublic information about the security. Insider trading violations may also include "tipping" such information, securities trading by the person "tipped," and securities trading by those who misappropriate such information."

Who qualifies as an insider?

The definition of an insider can vary slightly depending on the jurisdiction and the specific regulations in place, but generally, insiders include individuals who have access to nonpublic information about a company. The following categories of individuals are commonly considered insiders:

- Officers: This includes top executives such as the CEO (Chief Executive Officer), CFO (Chief Financial Officer), COO (Chief Operating Officer), and other high-ranking officers.

- Directors: Members of a company's board of directors are often considered insiders. This includes both executive directors (who are also officers of the company) and non-executive directors.

- Employees: Some employees, especially those in key positions or with access to sensitive information, may be classified as insiders. This can include individuals in finance, legal, research and development, and other departments.

- Major Shareholders: Individuals or entities that hold a significant percentage of a company's shares may be considered insiders, especially if they have access to nonpublic information.