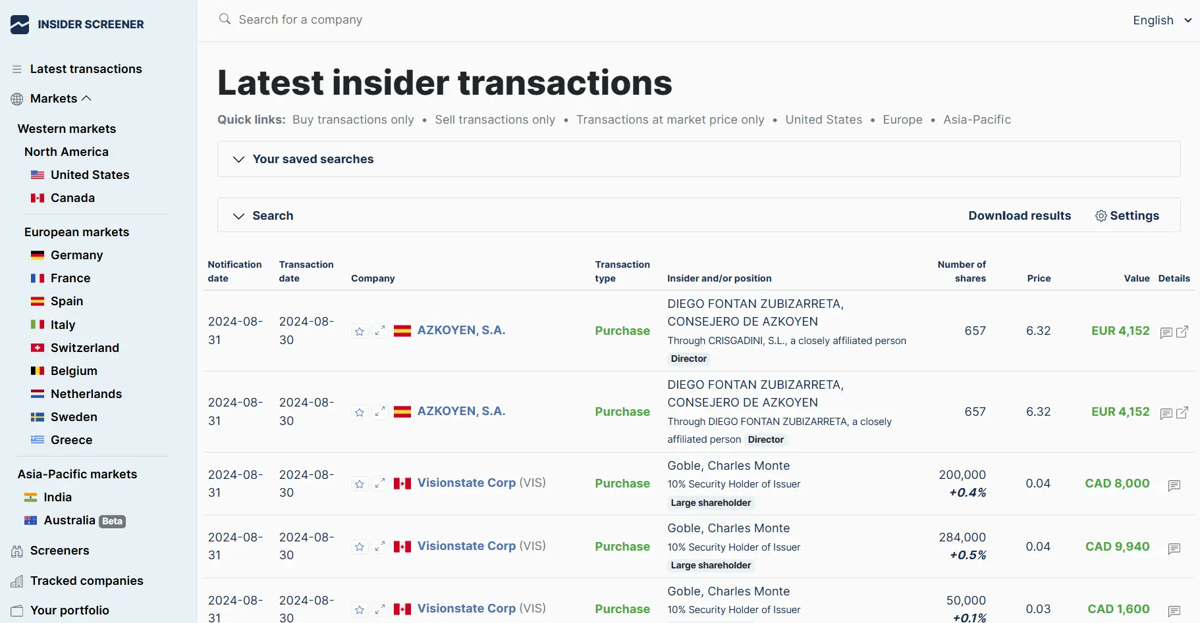

Toutes les transactions d'initiés des principaux marchés boursiers

Suivi des transactions d'initiés de qualité professionnelle pour investisseurs avertis

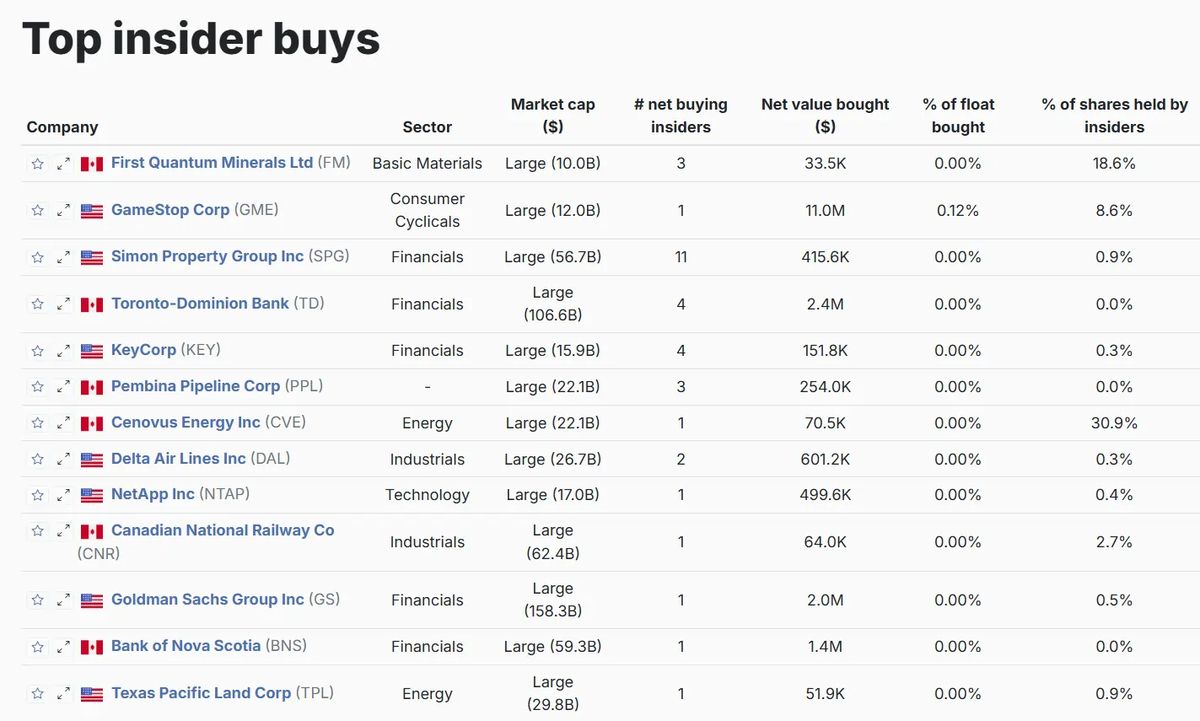

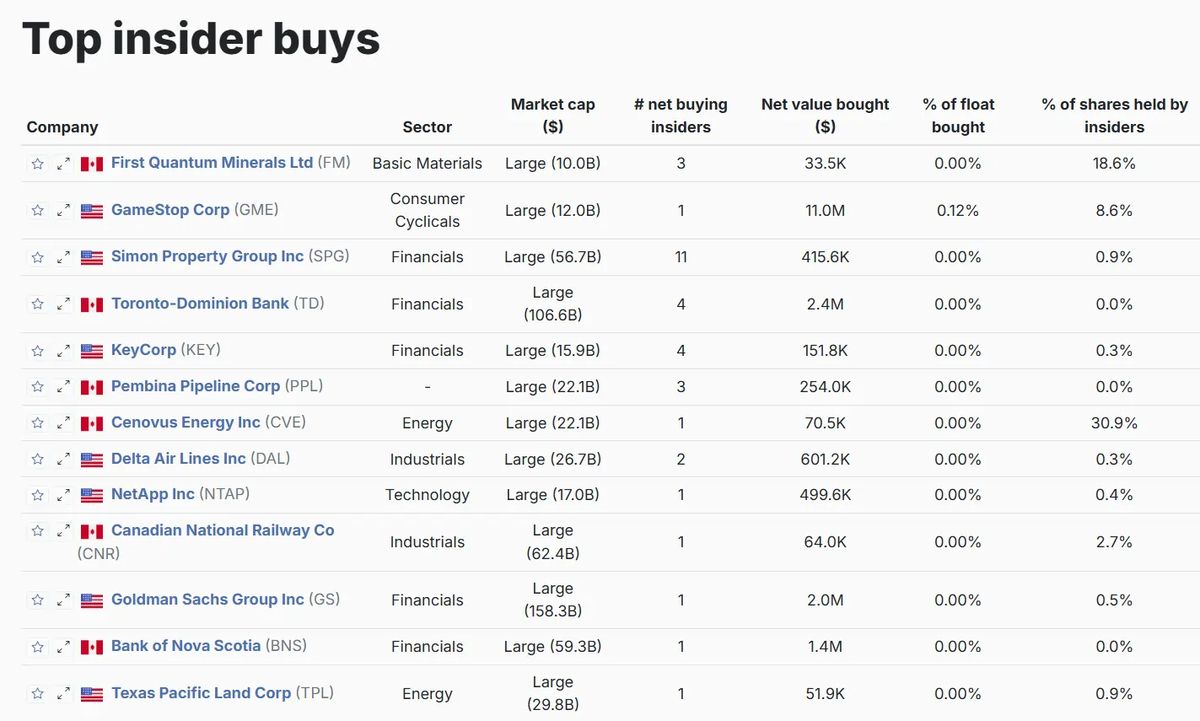

Trouver des actions que les initiés achètent et vendent

Suivez les entreprises ou industries de votre choix

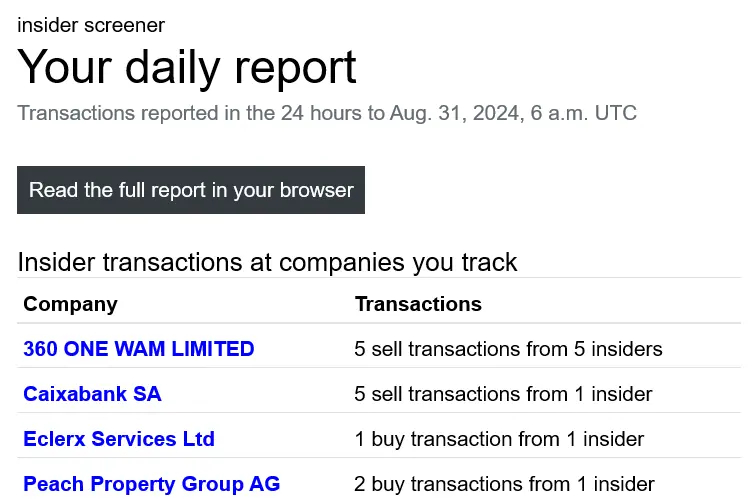

Recevez des rapports quotidiens par email

Utiliser les screeners pour identifier les transactions inhabituelles

Exportez les données vers Excel au format .csv ou .xlsx

Excluez les transactions non pertinentes grâce à nos outils de recherche avancée

Gagnez des heures de recherche

Accédez à une base de données mondiale de transactions d'initiés et découvrez des informations sur les délits d'initiés en quelques minutes. Identifiez rapidement les activités inhabituelles sans avoir à passer au crible d'innombrables documents.

Recherche sur les transactions d'initiés faite-maison

- Des heures passées à examiner des déclarations individuelles d'initiés

- Majorité de transactions non pertinentes

- Pas d'alertes

En utilisant insider screener

- Utilisez des filtres et la recherche avancée pour trouver des opportunités d'investissement.

- Détection automatique des transactions non pertinentes

- Rapport email quotidien

Suivez les transactions des dirigeants et initiés

Suivi des transactions d'initiés, tout-en-un

insider screener vous permet de suivre les transactions d'initiés sur les marchés mondiaux et de filtrer les transactions non pertinentes

Couverture mondiale

insider screener suit plus de marchés que les plateformes comparables, ce qui vous permet de découvrir des opportunités d'investissement sur des marchés négligés.

- Tous les grands marchés en un seul endroit.

- Données provenant d'une douzaine de marchés mondiaux, bien plus que les plateformes comparables - ce qui fait d'insider screener la plateforme de référence pour la recherche sur les transactions d'initiés

- Données standardisées.

- Les données sur les délits d'initiés sont normalisées, ce qui facilite les comparaisons.

- Informations fiables et actualisées en continu.

- Les données proviennent directement des déclarations réglementaires et sont mises à jour en permanence, ce qui vous permet de disposer des données les plus récentes.

Rapports email quotidien

Recevez des rapports quotidiens par e-mail dans votre boîte de réception, et assurez-vous de ne jamais manquer une transaction.

- Suivez des entreprises spécifiques.

- Soyez alerté quotidiennement des transactions liées aux entreprises que vous suivez.

- Critères personnalisés.

- Enregistrez vos recherches avancées et recevez des alertes quotidiennes lorsque de nouvelles transactions répondant à vos critères sont signalées.

Des informations précises grâce aux screeners

Les screeners analysent les données en continu afin de mettre en évidence les activités inhabituelles de transactions d'initiés.

- Activités de transactions d'initiés.

- met en évidence les actions qui font l'objet du plus grand nombre d'opérations, de la part de tous les initiés ou plus particulièrement des dirigeants.

- Contexte.

- insider screener met en évidence les délits d'initiés suite à des événements spécifiques, tels que la chute du cours de l'action.

- Les données en contexte.

- insider screener analyse l'activité des délits d'initiés à l'aide d'un modèle multifactoriel, afin de mettre les délits d'initiés dans le contexte d'une action spécifique.

Suivez les transactions des dirigeants et initiés

Bienvenue,

Les données sur le délit d'initié étaient autrefois difficiles d'accès. Elles étaient éparpillées sur différents sites web des régulateurs financiers, rendant la recherche des informations nécessaires complexe.

J'ai décidé de changer cela, et c'est ainsi qu'Insider Screener a vu le jour.

Aujourd'hui, insider screener est utilisé par des milliers d'investisseurs pour accéder aux données sur les transactions d'initiés.

À vrai dire, insider screener est le seul service offrant l'accès à des données pour autant de marchés à ce niveau de prix.

Si vous souhaitez intégrer l'analyse des transactions d'initiés à votre stratégie de trading ou d'investissement, essayez insider screener.

Emmanuel d'insider screener

P.S. Si vous avez des questions, n'hésitez pas à me contacter à l'adresse [email protected].

Populaire

Comment nous collectons et traitons les formulaires 4 et les déclarations d'initiés

Nous recueillons les données directement auprès des régulateurs financiers ou des bourses, selon chaque marché. Nous traitons rigoureusement les déclarations pour éliminer le bruit et mettre en lumière les transactions pertinentes pour les investisseurs.

Foire aux questions

Qu'est-ce qu'insider screener ?

insider screener facilite le suivi des transactions d'initiés.

Parce que lire les déclarations de transactions d'initiés publiées sur les sites des régulateurs financiers est fastidieux, nous rassemblons ces données, les analysons et les publions afin que vous puissiez trouver facilement les informations dont vous avez besoin.

Nous avons également développé plusieurs algorithmes pour détecter les transactions les plus pertinentes, puisqu'avec plus d'un millier de nouvelles transactions détectées chaque jour, identifier les transactions les plus pertinentes peut être difficile.

D'où les données viennent-elles ?

Nous recueillons les données directement auprès des régulateurs financiers ou des places boursières, selon les pays.

Les données relatives aux transactions d'initiés sont-elles légales ?

Les données relatives aux transactions d'initiés, qui concernent les informations sur l'achat et la vente d'actions d'une entreprise par ses dirigeants, ses administrateurs et ses employés, sont généralement légales et accessibles au public. Dans de nombreuses juridictions, les entreprises sont tenues de divulguer les transactions d'initiés à des organismes de réglementation tels que la Securities and Exchange Commission (SEC) aux États-Unis ou à des autorités réglementaires équivalentes dans d'autres pays.

Ces déclarations ont pour but d'assurer la transparence et de contribuer à la prévention des délits d'initiés.

Le délit d'initié n'est-il pas illégal ?

Une opération d'initié est l'achat ou la vente de titres d'une entreprise (tels que des actions ou des options) par des personnes qui ont accès à des informations non publiques sur l'entreprise, y compris des dirigeants, des administrateurs et des employés.

Les transactions d'initiés sont légales et ne doivent pas être confondues avec les délits d'initiés. La Securities and Exchange Commission définit le délit d'initié comme "l'achat ou la vente d'un titre, en violation d'une obligation fiduciaire ou d'une autre relation de confiance, sur la base d'informations matérielles non publiques concernant ce titre". Les violations du délit d'initié peuvent également inclure la transmission de ces informations, la négociation de titres par la personne informée et la négociation de titres par ceux qui détournent ces informations

Qui est considéré comme un initié ?

La définition d'un initié peut varier légèrement en fonction de la juridiction et de la réglementation spécifique en vigueur, mais en général, les initiés sont des personnes qui ont accès à des informations non publiques sur une entreprise. Les catégories de personnes suivantes sont généralement considérées comme des initiés

- Les dirigeants: Il s'agit des cadres supérieurs tels que le PDG, le directeur financier, le directeur des opérations et d'autres cadres de haut niveau.

- Administrateurs: Les membres du conseil d'administration d'une entreprise sont souvent considérés comme des initiés. Il s'agit à la fois des administrateurs exécutifs (qui sont également des dirigeants de l'entreprise) et des administrateurs non exécutifs.

- Employés: Certains employés, en particulier ceux qui occupent des postes clés ou qui ont accès à des informations sensibles, peuvent être considérés comme des initiés. Il peut s'agir de personnes travaillant dans les services financiers, juridiques, de recherche et de développement, etc.

- Actionnaires principaux: Les personnes ou entités qui détiennent un pourcentage important des actions d'une société peuvent être considérées comme des initiés, en particulier si elles ont accès à des informations non publiques.